Introduction – The Growing Voice of Retail Investors

In the past, global stock markets were dominated by large institutions—hedge funds, pension funds, and big banks. Retail investors, or everyday individuals trading through brokerage accounts, had a relatively small impact. However, in recent years, technology, social media, and democratized trading platforms have fundamentally altered the balance of power. Retail investor trends in markets today show that individuals now have unprecedented influence on market behavior, stock volatility, and even corporate decision-making.

This article explores the major retail investor trends shaping markets today, the forces behind them, the sectors attracting their attention, and what this means for the future of investing.

ESG Investing Trends in Stock Markets

1. The Rise of the Retail Investor Revolution

Democratization of Trading

The rise of commission-free trading platforms such as Robinhood, Webull, and eToro has lowered the barriers to entry for individuals. Decades ago, brokerage fees and complex account requirements kept small investors at bay. Today, anyone with a smartphone can trade stocks, ETFs, and even cryptocurrencies with minimal friction.

The Pandemic Effect

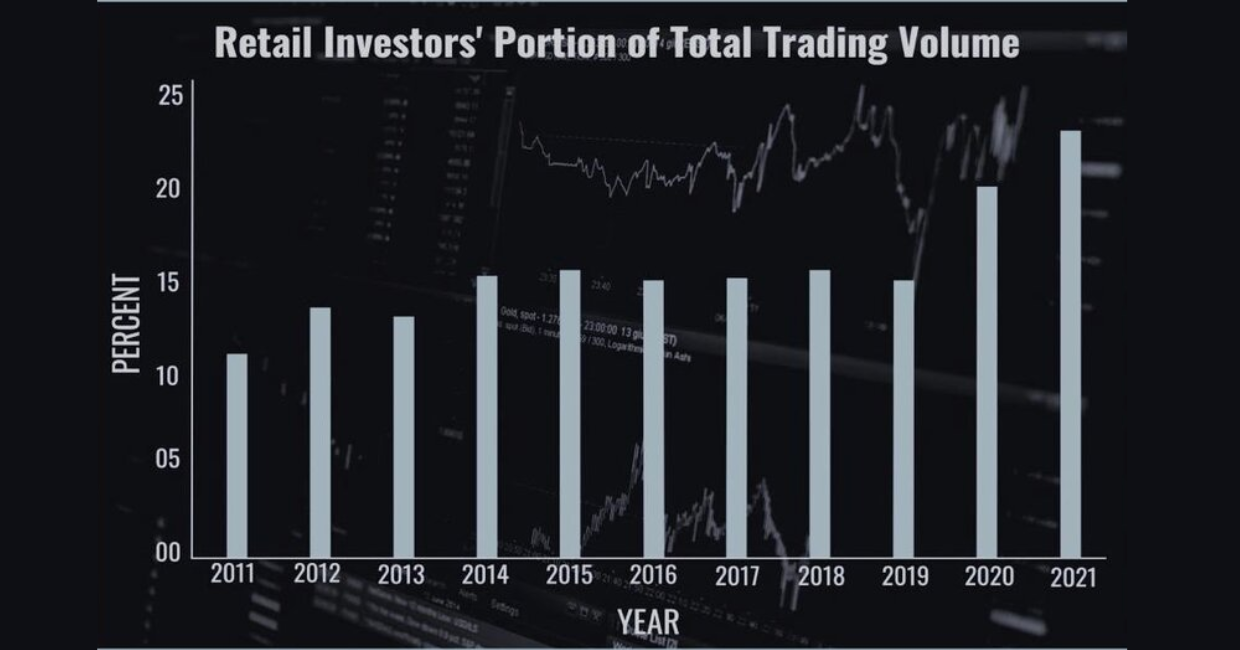

The COVID-19 pandemic acted as an accelerant. Lockdowns, stimulus checks, and extra time at home led millions of individuals to open trading accounts. According to various reports, retail investors now account for 20–25% of daily U.S. trading volume, a sharp increase compared to a decade ago.

Why it matters: The surge of retail investors has created new market dynamics where trends can emerge quickly and spread virally, amplifying both risks and opportunities.

2. Social Media and Community-Driven Investing

Meme Stocks and Online Forums

One of the most striking retail investor trends is the influence of social media platforms like Reddit’s r/WallStreetBets, Twitter (X), and TikTok. Communities coordinate around “meme stocks” such as GameStop and AMC, where viral narratives drive massive price surges detached from traditional fundamentals.

Power of Collective Action

These communities have shown that collective retail action can rival institutional players. In early 2021, coordinated buying forced short squeezes that inflicted billions in losses on hedge funds.

Risks of Hype-Driven Strategies

While online-driven investing can create life-changing gains for some, it also exposes inexperienced traders to high volatility and potential losses. The lack of fundamental analysis in hype-driven trades often makes them unsustainable.

Takeaway: Retail investors today are not just passive market participants—they are organized, vocal, and able to move markets in ways unimaginable just a decade ago.

3. Popular Asset Classes Among Retail Investors

Equities (Stocks)

Retail investors remain most active in equities, particularly tech stocks (Apple, Tesla, Nvidia, Microsoft) and small-cap speculative companies that promise outsized gains.

Exchange-Traded Funds (ETFs)

ETFs have gained traction as retail investors look for diversification at low costs. ESG-focused ETFs, thematic ETFs (like clean energy), and sector ETFs are particularly attractive to younger investors.

Cryptocurrencies

Crypto adoption among retail investors has exploded. Bitcoin, Ethereum, and altcoins such as Solana and Dogecoin have become staples in retail portfolios, despite volatility and regulatory uncertainty.

Options Trading

Perhaps the most surprising trend is the retail embrace of options trading. Zero-commission platforms have popularized leveraged strategies, allowing small traders to control large positions with limited capital.

Why it matters: Retail investors are no longer confined to blue-chip stocks—they now engage in complex strategies across diverse asset classes, reshaping market liquidity and volatility.

4. Retail Investor Demographics

Younger Investors Dominate

Millennials and Gen Z make up a large share of new retail investors. This generation tends to prefer mobile-first platforms, socially conscious investments, and high-risk/high-reward opportunities.

The Rise of the DIY Investor

With a wealth of financial information available online—YouTube tutorials, podcasts, blogs—retail investors today rely less on financial advisors and more on self-directed research.

Global Participation

Retail investing is not just a U.S. phenomenon. In Asia, apps like Upstox (India) and Tiger Brokers (China) are rapidly onboarding millions of young traders. In Europe, platforms such as Trade Republic and DEGIRO are seeing explosive growth.

Takeaway: Retail investing is becoming a global generational movement, with young investors shaping the next era of markets.

5. The Influence of Technology on Retail Investing

Fractional Shares

Platforms offering fractional shares allow retail investors to buy portions of expensive stocks like Amazon or Google with as little as $1. This has made high-value companies accessible to everyone.

Algorithmic and Automated Tools

Retail investors increasingly use robo-advisors and algorithmic trading bots to automate strategies once exclusive to hedge funds.

Real-Time Market Access

Mobile apps with instant notifications, real-time quotes, and social trading features keep retail investors more engaged than ever.

Why it matters: Technology has leveled the playing field, allowing individuals to use tools previously reserved for institutions.

6. Retail Investors and Market Volatility

Short-Termism and Day Trading

Many retail investors adopt short-term trading strategies, hoping to capitalize on daily or weekly price swings. This creates higher volatility in certain stocks.

Impact on Market Liquidity

Retail flows often concentrate in a handful of trending stocks, amplifying liquidity in some areas while leaving others less traded.

Contrarian vs. Institutional Moves

At times, retail traders act contrarian to institutional flows, creating unusual price patterns. For instance, retail buying often surges when institutions sell off, temporarily propping up prices.

Takeaway: The influence of retail flows is now strong enough to move prices, particularly in small- and mid-cap stocks.

7. ESG and Value-Based Investing Among Retail Investors

Alignment with Personal Values

A key retail investor trend today is the emphasis on value-based investing. Many prefer companies that align with environmental, social, and governance (ESG) principles.

Climate and Clean Energy Focus

Renewable energy firms, EV manufacturers, and sustainable tech companies attract significant retail interest.

Ethical Concerns

Retail investors are less tolerant of companies with scandals related to human rights, governance failures, or environmental damage.

Why it matters: Retail investors are pushing companies toward accountability and sustainability, reinforcing broader ESG trends in global markets.

8. Education, Awareness, and Financial Literacy

Learning by Doing

Retail investors today are more experimental, often learning from small trades before scaling up.

Access to Free Content

Platforms like YouTube, Substack newsletters, and Discord groups provide free education. While quality varies, this access lowers the learning barrier.

Increased Risk Awareness

Although not all retail investors are well-versed in risk management, many are becoming more aware of the importance of diversification, stop-losses, and asset allocation.

Takeaway: Retail investors are evolving from speculative traders to more informed participants, though risk-taking remains high.

9. Challenges Facing Retail Investors

Overconfidence and Speculation

Many new traders overestimate their ability to “beat the market,” leading to risky trades and potential losses.

Information Overload

The abundance of free online advice can overwhelm new investors, making it hard to distinguish fact from hype.

Market Manipulation Risks

Retail investors can be vulnerable to pump-and-dump schemes or misleading narratives spread on social media.

Regulatory Scrutiny

Regulators are increasingly monitoring retail trading platforms to ensure investor protection, especially around complex products like options and crypto.

Why it matters: The success of retail investors depends on balancing access and freedom with adequate safeguards.

10. The Future of Retail Investing

Institutional Recognition of Retail Power

Institutions now monitor retail flows closely. Hedge funds and asset managers use sentiment analysis tools to track retail activity in real time.

Integration of Social Trading

Platforms may continue to blur the line between investing and social networking, making community-driven investing the norm.

AI and Personalization

Artificial intelligence will increasingly power personalized investment recommendations tailored to individual risk profiles.

Greater Role in Corporate Governance

As retail investors become more organized, they may exert more influence on shareholder votes, board elections, and corporate ESG policies.

Outlook: Retail investors are not a passing fad—they are here to stay as a permanent force in shaping global financial markets.

Practical Advice for Retail Investors

- Focus on Fundamentals – Don’t get swept up in hype without understanding company performance.

- Diversify – Spread risk across sectors, asset classes, and geographies.

- Avoid Emotional Decisions – Market swings can be intense; discipline is key.

- Use Technology Wisely – Tools and apps can help, but avoid overtrading.

- Stay Educated – Continue learning, and separate credible analysis from online noise.

Conclusion – Retail Investors as Market Game Changers

The influence of retail investors in markets today is undeniable. What started as a niche group of traders has transformed into a global movement, reshaping how stocks are traded, priced, and even governed. The combination of technology, community-driven platforms, and generational shifts has given retail investors a louder voice in the financial ecosystem.

Retail investor trends in markets today highlight both opportunities and risks. On one hand, individuals now have the tools to participate actively, diversify portfolios, and influence corporate behavior. On the other, hype-driven strategies, speculation, and volatility can lead to significant losses.

The future of markets will likely be defined by a balance between institutional sophistication and retail passion. In this new era, retail investors are not just participants—they are active shapers of market dynamics.