Introduction

The stock market has always been a dynamic and ever-evolving landscape. For long-term investors, staying ahead of major trends is critical to building wealth and securing financial stability. While short-term traders may focus on daily fluctuations and quick profits, long-term investors think differently: they focus on macroeconomic factors, business cycles, technological progress, and market behaviors that can shape investments for decades.

In this article, we will explore the key stock market trends that matter for long-term investors, analyzing both historical lessons and future possibilities. We will also discuss how global economic shifts, digital transformation, sustainable investing, and demographic changes are shaping the opportunities and risks for patient investors.

ETF Trends for 2025 and Beyond

The Importance of Long-Term Thinking

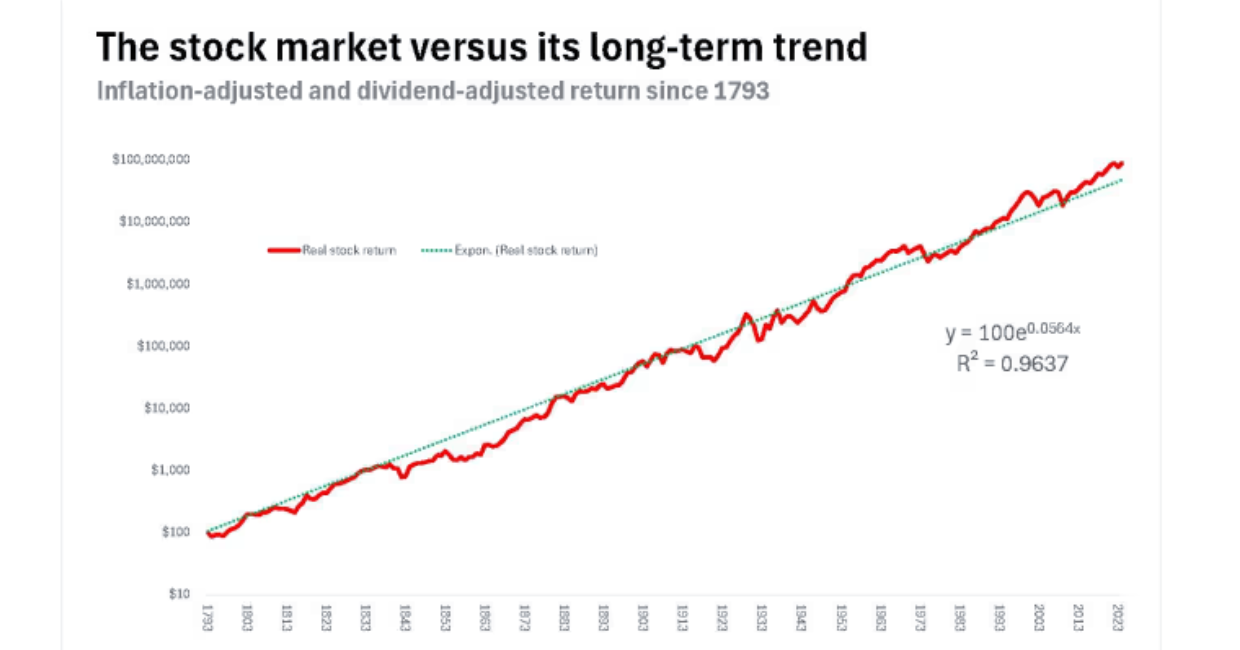

Long-term investing means focusing on growth that compounds over years, rather than reacting to temporary volatility. Market corrections, recessions, and even financial crises become opportunities when seen from a broader perspective. For instance, investors who stayed invested through the 2008 global financial crisis and continued to buy quality stocks saw tremendous gains in the following decade.

A long-term perspective allows investors to:

- Benefit from compound growth.

- Focus on fundamentals rather than noise.

- Ride out market volatility with patience.

- Capture structural trends that play out over decades.

With this mindset, let’s analyze the most relevant stock market trends that long-term investors should monitor.

Trend 1: Technological Innovation as a Market Driver

Technology has been at the heart of stock market growth in recent decades. From the rise of the internet in the 1990s to the dominance of cloud computing, artificial intelligence, and e-commerce today, innovation continues to fuel long-term gains.

- Artificial Intelligence (AI): Companies leveraging AI for automation, data analysis, and customer engagement are likely to be market leaders in the future. Firms like Microsoft, Nvidia, and Alphabet are prime examples of AI-driven growth.

- Cybersecurity: With digitalization comes security risks. Demand for robust cybersecurity solutions is expected to rise, benefiting firms in this sector.

- Green Technology: Innovations in renewable energy, electric vehicles (EVs), and battery storage are creating new long-term opportunities. Tesla, for instance, redefined the auto industry through innovation and has inspired traditional carmakers to follow suit.

For long-term investors, identifying companies that continuously innovate is one of the most reliable strategies for growth.

Trend 2: The Rise of Sustainable and ESG Investing

Environmental, Social, and Governance (ESG) investing has moved from a niche concept to a mainstream trend. Investors today are increasingly conscious of how businesses impact the environment and society.

- Environmental Impact: Companies with clean energy policies, low carbon emissions, and renewable energy usage are attracting more capital.

- Social Responsibility: Firms that prioritize fair labor practices, diversity, and social equity stand to build stronger reputations and long-term customer loyalty.

- Governance: Strong corporate governance reduces risks related to fraud, corruption, and mismanagement.

For long-term investors, ESG investing is not just about ethics—it’s about identifying resilient businesses that will thrive in a future shaped by climate concerns, regulatory pressures, and shifting consumer values.

Trend 3: Demographic Shifts and Their Market Impact

Population changes have always influenced economies and markets. Long-term investors must consider demographic trends when making decisions.

- Aging Populations: In developed countries, aging populations are driving demand for healthcare, pharmaceuticals, retirement planning, and senior care services. Companies in these sectors are expected to grow steadily.

- Emerging Middle Class: In developing countries such as India, Indonesia, and African nations, the rise of a large middle-class population creates demand for consumer goods, financial services, and technology.

- Urbanization: As more people move to cities, infrastructure, housing, transportation, and technology-driven services are becoming long-term investment themes.

These shifts create opportunities in sectors such as healthcare, consumer discretionary, fintech, and infrastructure.

Trend 4: Globalization Versus Localization

For decades, globalization fueled corporate growth by opening new markets and supply chains. However, recent years have seen a countertrend—localization.

- Globalization: Multinational corporations benefit from scale, diversified revenue streams, and access to emerging markets. Tech giants and consumer brands thrive on global reach.

- Localization: Rising geopolitical tensions, supply chain disruptions, and protectionist policies have encouraged companies to focus on domestic production and regional markets.

For long-term investors, this means balancing portfolios with companies that can adapt to both global opportunities and local resilience.

Trend 5: The Role of Monetary Policy and Inflation

Macroeconomic policies significantly influence long-term market trends.

- Interest Rates: Low interest rates over the past decade fueled growth in technology and real estate sectors. However, higher interest rates can shift investor focus toward value stocks and dividend-paying companies.

- Inflation: Persistent inflation can erode returns, but companies in sectors such as commodities, energy, and consumer staples often provide a hedge.

- Central Bank Policies: Long-term investors need to understand how central banks’ actions shape liquidity, borrowing costs, and overall market direction.

A diversified strategy that considers both growth stocks and defensive sectors can protect investors from policy-related volatility.

Trend 6: The Power of Index Funds and Passive Investing

One of the most significant long-term stock market trends has been the rise of passive investing through index funds and ETFs (Exchange-Traded Funds).

- Low Costs: Passive funds often outperform actively managed funds over the long run due to lower management fees.

- Diversification: Index funds allow investors to spread risk across multiple sectors and companies.

- Market Growth: With trillions of dollars now invested in passive vehicles, the trend is expected to continue, influencing overall market dynamics.

For long-term investors, allocating part of their portfolio to passive strategies is often a stable and effective choice.

Trend 7: Volatility and the Importance of Resilience

Market volatility is inevitable. Crises such as the 2000 dot-com bust, the 2008 financial crash, and the 2020 pandemic remind us that downturns happen regularly. For long-term investors, the key is resilience.

- Quality Stocks: Companies with strong balance sheets, durable competitive advantages, and consistent earnings tend to recover faster from downturns.

- Dividend Stocks: Firms that pay reliable dividends provide steady returns even during market turbulence.

- Diversification: Balancing investments across asset classes, sectors, and geographies reduces risk.

By focusing on resilience, long-term investors can navigate volatility while continuing to build wealth.

Trend 8: Digitalization of Financial Markets

The way people invest has changed dramatically. Online trading platforms, robo-advisors, and mobile apps have democratized investing.

- Retail Investors: More individuals now participate in the stock market than ever before, creating new dynamics in trading volume and stock valuations.

- Blockchain and Tokenization: New technologies may allow traditional assets like stocks and real estate to be tokenized, improving liquidity and accessibility.

- Artificial Intelligence in Finance: AI-driven algorithms can assist with portfolio management, risk assessment, and market predictions.

This digital revolution means long-term investors have greater access to tools, data, and opportunities than previous generations.

Trend 9: Emerging Markets as Growth Engines

While developed markets remain stable, emerging markets represent some of the fastest-growing opportunities for long-term investors.

- Asia: India, Vietnam, and Indonesia are among the fastest-growing economies, with expanding consumer bases.

- Africa: With its young population and untapped resources, Africa is expected to be a major growth region in the coming decades.

- Latin America: Countries like Brazil and Mexico provide opportunities in natural resources, agriculture, and technology.

Investing in emerging markets comes with risks—political instability, currency fluctuations, and weaker institutions—but the potential rewards for long-term investors are substantial.

Trend 10: Behavioral Shifts in Investor Psychology

Investor psychology plays a vital role in market behavior. Trends such as herd mentality, fear of missing out (FOMO), and panic selling often create market distortions. Long-term investors must remain disciplined and rational.

- Patience Over Impulse: Avoid reacting to short-term news.

- Value-Oriented Decisions: Focus on fundamentals instead of hype.

- Behavioral Awareness: Recognizing biases helps investors avoid costly mistakes.

Understanding psychology not only helps investors manage their own portfolios but also allows them to anticipate broader market movements.

Strategies for Long-Term Investors in a Changing Market

With so many trends shaping the stock market, how should long-term investors position themselves?

- Diversify Globally: Spread investments across sectors and regions.

- Focus on Quality: Prioritize companies with strong balance sheets and competitive advantages.

- Adopt a Long-Term Horizon: Ignore short-term noise and focus on structural growth.

- Balance Growth and Value: Hold both high-growth tech stocks and stable dividend payers.

- Stay Educated: Follow economic developments, policy changes, and industry innovations.

Conclusion

The stock market will always evolve, shaped by technology, demographics, global shifts, and human psychology. For long-term investors, success lies in identifying enduring trends, resisting short-term panic, and maintaining a disciplined approach.

From AI-driven innovation to sustainable investing, from emerging markets to demographic transformations, the opportunities are vast for those who think beyond the next quarter. By embracing patience, resilience, and strategic foresight, long-term investors can build not just wealth but lasting financial security.